Ways to Give

Empower Communities with Your Gift

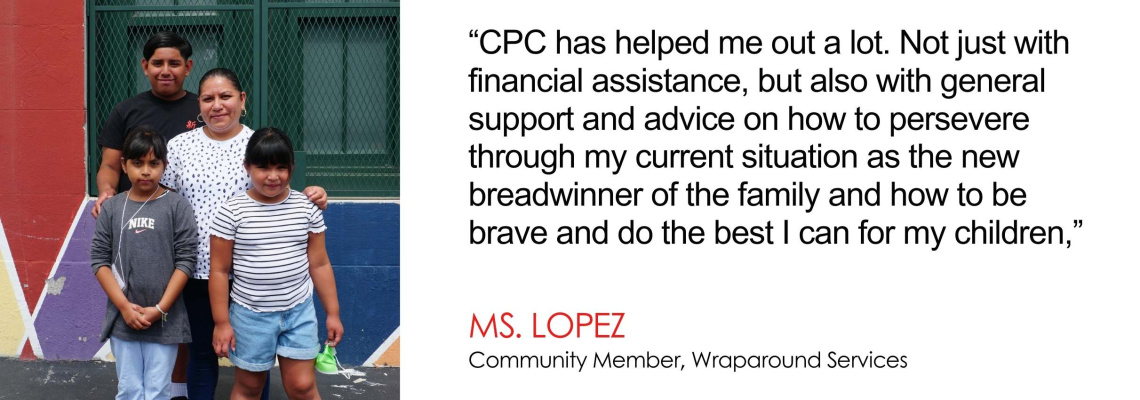

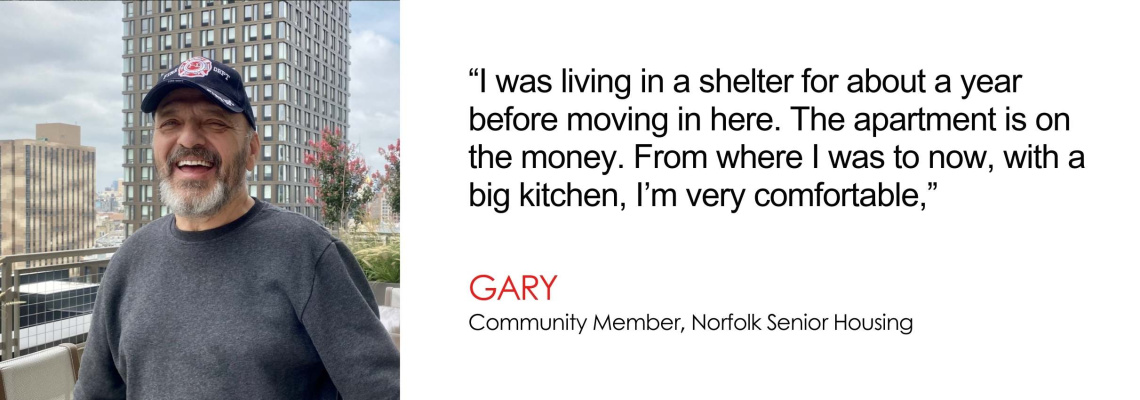

Every donation to CPC opens new opportunities for Asian American, immigrant, and low-income New Yorkers.

Join CPC’s Community Circle, our monthly giving program, to provide reliable support for our ongoing initiatives. Your contributions will help us create responsible and innovative resources for our community. Click here to join today! For further questions contact Paloma Thoen at pthoen@cpc-nyc.org or 212-941-0920 x 181.

Please make checks payable to Chinese-American Planning Council, Inc. and mail to:

Attn: Development

Chinese-American Planning Council, Inc.

45 Suffolk Street, 3rd Floor

New York, NY 10002

To designate your contribution for a specific program, include the program name in the memo line.

Many employers offer matching gift programs for donations. Check out Charity Navigator’s free search tool to learn more or contact your HR department to see if your company has a matching gift program. For further assistance, contact Paloma Thoen at pthoen@cpc-nyc.org or 212-941-0920 x 181.

Leave a lasting impact by including CPC in your estate plans.

To include CPC in your will or trust, we suggest the following language: "I give to the Chinese-American Planning Council a not-for-profit institution incorporated by the laws of the State of New York, having as its principal address of 45 Suffolk Street, New York, 10002, federal tax identification number (EIN): 13-6202692 [the sum of $______ or _____% of my estate or residuary estate] to be used for its general purposes."

Other ways to include CPC in your legacy:

IRA/Retirement Account: Contact your retirement plan administrator, bank or financial institution for a change-of-beneficiary form. Decide what percentage you would like us to receive and name us, along with the percentage you chose, on the beneficiary form.

Include CPC’s federal tax ID # 13-6202692.

Insurance Policy: You can make CPC a partial or full beneficiary of your life insurance policy. Contact your insurance administrator and request a form.

Life Income Gifts: Through a Charitable Gift Annuity or a Charitable Remainder Trust, you can provide income for life for you and/or a loved one while also supporting CPC.

For more info or questions, contact Kaitlyn Mar at kmar@cpc-nyc.org or 212-941-0920 x156. To ensure prompt acknowledgment, please reach out to Kaitlyn directly.

If you are interested in pursuing a corporate partnership with CPC to create meaningful impact through partnerships, volunteer opportunities, sponsorship, or other collaborations, contact Mabel Long at mlong@cpc-nyc.org or 212-941-0920 x140.

Maximize your impact by making a gift of appreciated securities – like stocks, bonds, ETFs and mutual funds – and avoid capital gains taxes. And if you itemize, you may also receive a tax deduction.To donate publicly traded securities, provide your broker with the following information to initiate your donation:

- Account Name: Chinese-American Planning Council, Inc.

- EIN#: 13-6202692

- DTC #: 0062

- Account #: 65869673

- Reference line: Donor’s Name

For prompt acknowledgment, share the donor’s name, stock symbol, number of shares, and approximate donation value with Kaitlyn Mar at kmar@cpc-nyc.org or 212-941-0920 x156.

If you have a DAF, you can recommend a grant to the Chinese-American Planning Council, Inc., tax ID number 13-6202692. You can also include CPC as a full or partial beneficiary of your DAF. To ensure a prompt tax-deductible receipt for your gift, contact Kaitlyn Mar at kmar@cpc-nyc.org or call 212-941-0920 x 156.

In-kind donations play a vital role in helping individuals and families create brighter futures. We evaluate these contributions on a case-by-case basis to ensure they meet our current program needs. To discuss this option, contact Kim To at kto@cpc-nyc.org or 212-941-0920 x 157.

Crowdfund for CPC on Classy, GoFundMe, Instagram, or Facebook to amplify your impact. For a crowdfunding toolkit, contact Paloma Thoen at pthoen@cpc-nyc.org or 212-941-0920 x 181.

If you hold crypto currency, you can transfer it to CPC and receive a tax deduction for the currency’s fair market value. To ensure a prompt acknowledgment of your gift, contact Kaitlyn Mar at kmar@cpc-nyc.org or call 212-941-0920 x 156.

If you’re 70 ½ or older, you can use your Qualified Charitable Distribution (QCD), up to $108,000 per person in 2025. If you’re 73 or older, you can use your Required Minimum Distribution (RMD) to support CPC. To arrange a QCD or RMD from your IRA, contact your financial institution to send all or part of your RMD to the Chinese-American Planning Council (EIN: 13-6202692) at 45 Suffolk Street, New York, NY 10002. The check must be sent directly from the institution to CPC to qualify.

To ensure a prompt acknowledgment of your gift, contact Kaitlyn Mar at kmar@cpcnyc.org or call 212-941-0920 x 156.

Join CPC at an upcoming special event, where you’ll connect with hundreds of philanthropic, business, and government leaders to celebrate and honor our vibrant community. Click here to get tickets to an upcoming celebration. For questions regarding tickets and sponsorship opportunities, contact Mabel Long at mlong@cpc-nyc.org or 212-941-0920 x 140.

CPC is a 501c3 not for profit, EIN 13-6202692.

45 Suffolk Street, New York, NY 10002

All donations will be acknowledged, publicly recognized if desired, and will receive the associated benefits.

The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor.